These are usually. Are there any countries with low taxes in Europe.

Fresh Oecd Figures On Minimum Wage Taxes Show Slovakia Beating Countries Like Germany The Usa And France How Does Your Heart Of Europe Minimum Wage Slovenia

The full table shows the top rates of income tax paid in each country dating back to 2003.

Low tax countries. The Netherlands has drawn up new list of 21 low-tax jurisdictions to help implement new measures to combat tax avoidance. 15 COUNTRIES WITH NO TAXES. Here are the top three countries to go to escape huge taxes.

Countries with zero tax. Will the tax rates for 201819 affect you in England. 226 rows A comparison of tax rates by countries is difficult and somewhat subjective as tax laws in.

Many lowno tax countries generate governmental revenue via other sources. American Samoa the US Virgin Islands Guam Samoa and Trinidad and Tobago. Some countries like Portugal arent low tax on locally-sourced income but they do have golden visa programs which can allow you to pay close to zero in taxes.

So one of the most effective ways of lowering your taxes is to move to a territorial tax. This page displays a table with actual values consensus figures forecasts statistics and historical data charts for - List of Countries by Personal Income Tax Rate. Plus some tax-free countries like Somalia for example tend not to be super livable This is why most investors prefer to find a low-tax country rather than a tax-free country.

This can differ depending on the country. For example many of the Gulf countries dont charge income tax because they generate huge amounts of revenue from their public oil industries. And if you dont want the whole Brexit deal to have anything to do with you then its time to move from your country of origin to greener pastures financially speaking.

The following are not tax-free countries but they tax their residents on a territorial basis and to the best of our research dont have CFC laws. Low-tax and no-tax countries are thus somewhat similar in that you can feasibly pay no taxes in those places but in low-tax countries you may need to pay in certain situations. The following list includes all countries without any kind of income tax.

The city has been one of the most attractive places in the world for businesses with a low-tax environment that goes back to the 1960s. The list was published today in the Government Gazette. List of Countries by Personal Income Tax Rate - provides a table with the latest tax rate figures for several countries including actual values forecasts statistics and historical data.

This essentially means that these countries tax only the income earned from activity within their borders not overseas income. Low Tax Countries. The global average tax rate is 3123 rising to a high of 3827 in the European Union and a low of 2799 in Africa.

The reason why tax-free countries arent so popular is that there are only a handful of countries in the world that have that system. As of today there are 15 countries with no income tax in the world. The research also offers information about social security rates paid by employers and employees in each country.

The list contains five jurisdictions that are currently blacklisted by the European Union.

Eg Platform Orang Asli Baccarat

Total Tax Revenue Us Taxes Are Low Relative To Those In Other Developed Countries In 2014 Us Taxes At A Developing Country Gross Domestic Product Social Data

Higher Or Lower How Do You Think Your U S Tax Burden Compares To Other Countries Thinking Of You Other Countries Country

Progressiveness Of Taxes Informative Facts Tax

No Country For Income Tax International World Of Business

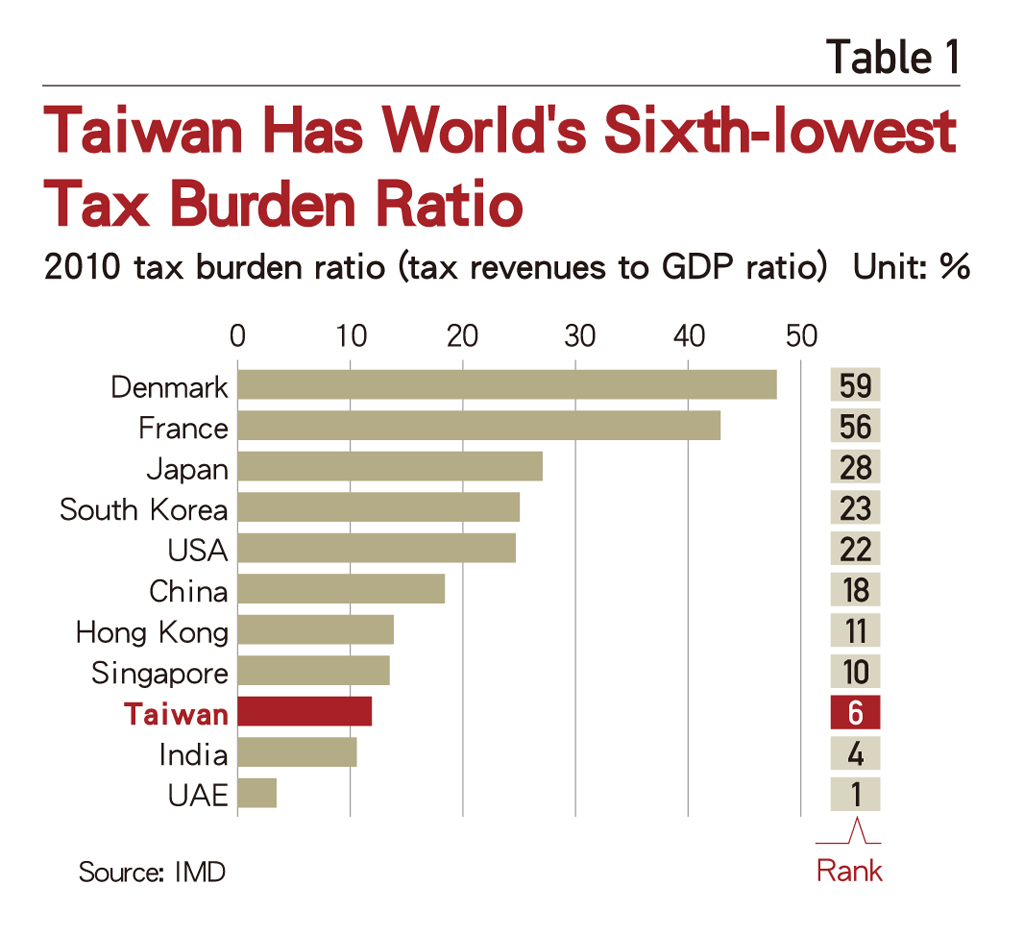

Taiwan S Unfair Tax System Helping The Rich Get Richer Industry 2012 09 20 Commonwealth Magazine

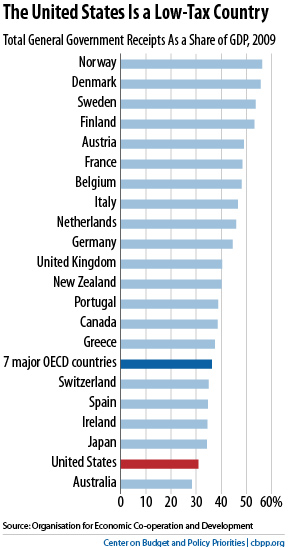

Us Is A Low Tax Country Occasional Links Commentary

What Are The Countries Where People Pay The Most Tax And The Least Tax Quora

Index Of Wp Content Uploads 2011 04

Are Total Taxes Higher In The Usa Or Europe Quora

World Economic Forum On Twitter World Economic Forum Corporate Economy

Estimated Tax Revenue Loss As A Share Of Gdp For Low Income Download Scientific Diagram

The World S Most Competitive Tax Systems Infographic Infographic Economic Trends Tax

High Tax Vs Low Tax Countries Youtube

Pandora Papers How The Fight Against Tax Avoidance Is Going Business Economy And Finance News From A German Perspective Dw 06 10 2021

Tax Incentives For Giving Are Effective Even In Low Income Countries Rules To Give By Index Published Future World Giving

Republican Tax Lie Low Tax Countries Fare Best The Politically Moderate Christian